how to transfer money from india to usa without tax

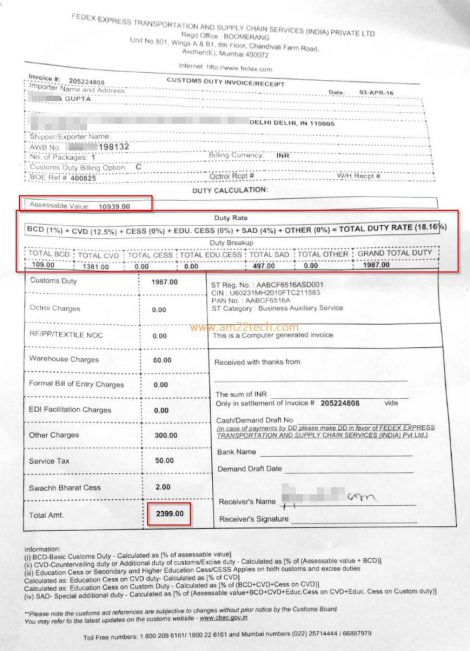

Online Money Transfer Service Providers. However you must declare it to the IRS by submitting Form 3520 if it exceeds US 100000 for any given year.

Tax Free Money Transfer India To Usa A Complete Guide To 2022

Enter the amount in USD you need to transfer the purpose of remittance and click on get rates.

. This limit is charged on a per-person. Sending money from India to USA can be done in 4 easy steps. Transfer of gifts under USD 50000 per do not require any paperwork.

If the DTAA is signed between India and the country of residence of the NRI the NRI will not be paying double taxes on the same source of income. If you send an annual federal gift above 14000 per person per year then your amount will be taxable and the sender needs to pay the taxes on the taxable amount. US taxes on money transfers.

Transfer money from India to the USA the hassle-free way. Please follow the link Notifications There is no tax on remittance but the Income has to be tax paid the bank would require such a certificate from your Chartered Accountant. Tax matters are seldom straightforward so getting some professional advice can help set your mind at rest if youre sending money from India to the USA.

Top Online Money Transfer. Send low-cost international payments from India to the US with WiseAll transfers use the mid-market. If you are sending money to India from the US then it depends on the amount you are sending and purpose of the transfer.

Rose sends Rs 3 lakh from India to Canada two times once to her elder sister working there maintenance of close relative abroad and the other time to her younger. For those receiving financial gifts through an international money transfer you wont pay taxes but you may be required to report the gift to. There is no tax as from Indian tax point of view you can gift unlimited funds to close relative.

Online money transfer service providers offer the best exchange rate and lowest transfer fees. 4 steps for Bringing money from India to USA from an NRE Account. NRIs will however need to.

The deposits in this type of account are repatriable without any upper limit because there are no tax liabilities. If the transfer is about. When you send money to any persons abroad in India the first 15000 USD will be exempt from taxes by the IRS under the Gift Tax policy.

The money sent from India to the US is not taxable. In most cases double. Answer 1 of 2.

Gifts over 15000 and business transfers over 10000 have to be. In the US there is an inheritance or estate tax levied at. To begin the transfer of money from India to the US the NRI should get a certificate from a chartered accountant CA in India.

11 Youtube Videos How To Send Money By Companies In 2022 Send Money Money Transfer Money Online

Understanding Tcs On Foreign Remittance Sbnri

How To Send Used Mobile To India By Usps Fedex From Usa Usa

How To Bring Money From India To The Usa Wise Formerly Transferwise

International Money Transfer Scotiabank Canada

How Much Money Can I Transfer Internationally

Bringing Money From India To Usa Do It Using Nre Nro Account 2021

![]()

Bringing Money From India To Usa Do It Using Nre Nro Account 2021

![]()

Bringing Money From India To Usa Do It Using Nre Nro Account 2021

How To Send Money From India To The Us Compareremit

Transfer Money To Usa Send Money From India To Usa Bookmyforex

International Money Transfer App

/images/2021/08/16/cryptocurrency-taxes.jpg)

9 Different Ways To Legally Avoid Taxes On Cryptocurrency Financebuzz

International Money Transfer App

How To Bring Money From India To The Usa Wise Formerly Transferwise

How To Send Money From India To The Us Compareremit

Cheapest Way To Transfer Money From India To Usa Extravelmoney

Transfer Money From Abroad To India From Australia Usa Uk Europe Canada Singapore To India Youtube

Tax Regulations To Consider In Borrowing From Or Lending By Friends Or Relatives Mint